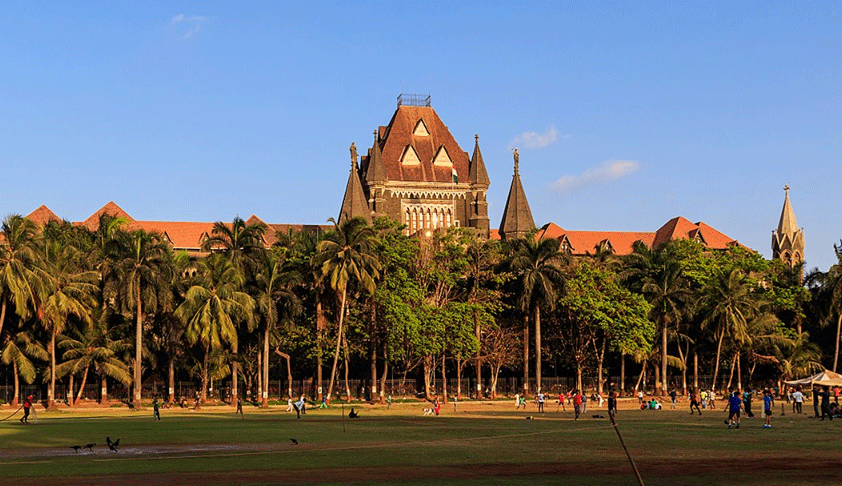

Bombay High Court

Taxpayers Can't Seek Writ Remedy By Bypassing Statutory Requirements Of Pre-Deposit: Bombay High Court

The Bombay High Court held that circumstances in which the appeals require some percentage of the demanded tax to be pre-deposited, do not render the appellate remedies any less efficacious.The High Court held so while considering an issue as to whether the demands are covered under the exemption notification or the notification providing for nil rate of taxes. The Division Bench of Justice M S Sonak and Justice Jitendra Jain observed that the practice of instituting petitions bypassing the...

Customs Act | Interest U/S 28AA Is Automatic When There Is A Default Or Delay In Payment Of Duty: Bombay High Court

The Bombay High Court ruled that the demand for interest u/s 28AA of the Customs Act raised for non-payment of demand, within three months of raising the demand, is properly tenable on the part of the Customs Authority.Interest u/s 28AA is automatic, when there is a default or delay in payment of duty, added the Court. Section 28AA of the Customs Act provides that any judgment, decree, order or direction of any Court or Appellate Tribunal or in any other provision of the said Act or the rules...

Writ Courts Shall Not Act As Court Of Appeal Against Decision Of Lower Court Or Tribunals To Correct Errors Of Fact: Bombay High Court

The Bombay High Court recently clarified that writ courts shall not trench upon an alternate remedy provided by statute (Income tax Act) for granting any relief, by assuming jurisdiction under Article 226 of the Constitution.Similarly, writ courts shall not act as a court of appeal against the decision of the lower court or Tribunals, to correct errors of fact, observed the Division Bench of Justice M. S. Sonak and Justice Jitendra Jain. Facts of the case: A show cause notice (SCN) was issued...