Tax

Obligation Under CENVAT Credit Rules, 2004, Cannot Be Transferred To Recipient Of Credit: CESTAT

The Mumbai Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that the obligation under rule 3(1) of CENVAT Credit Rules, 2004 cannot be transferred to the recipient of credit under rule 7 of CENVAT Credit Rules, 2004. The Bench of C J Mathew (Technical) has observed that, “the mechanism provided in rule 7 of CENVAT Credit Rules, 2004, governing the distribution of such credit, deems the credit so distributed to be eligible credit for the purpose of...

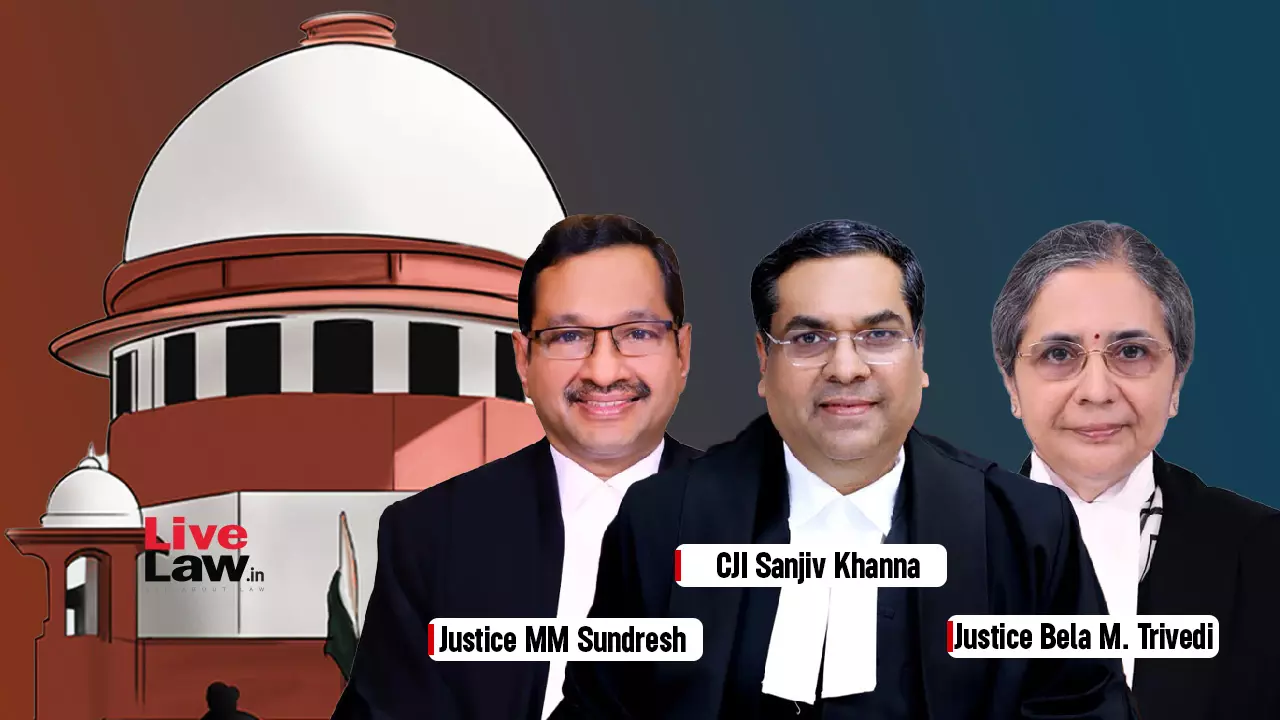

Some Merit In Allegations That GST Officials Coerce Assesses To Pay Tax With Threat Of Arrest; It's Impermissible: Supreme Court

The Supreme Court on Thursday (February 27) observed that there was some merit in the allegation that tax officials coerce assesses to pay the Goods and Services Tax with the threat of arrest. This observation was made by the Court on the basis of data.The Court said that if any person is feeling coerced to pay GST, they can approach the writ court for refund of the tax paid by them under coercion. The Court also said that the officers who indulge in such coercion must be dealt with...

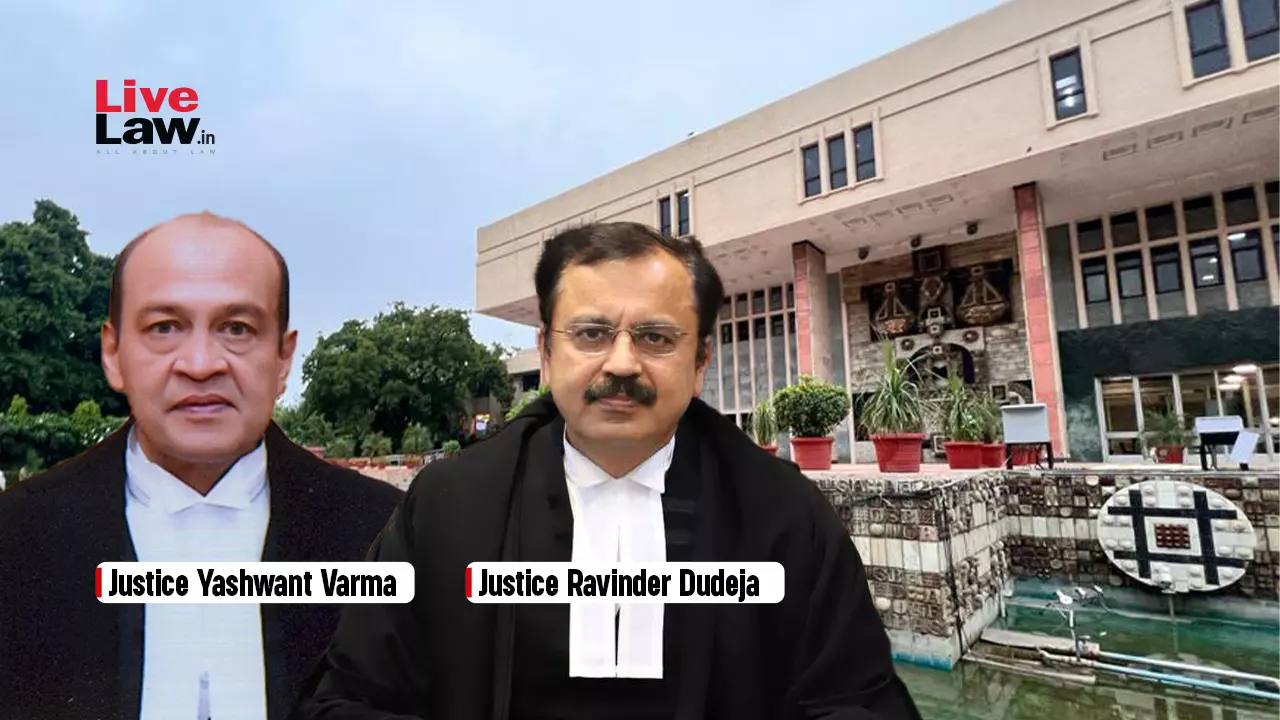

DTAA | Subsidiary Of A Company Does Not Ipso Facto Constitute Its Permanent Establishment: Delhi High Court

The Delhi High Court has held that a subsidiary or an entity which is substantially controlled by another entity in a contracting State does not by itself become a Permanent Establishment (PE) of that other entity.Citing Article 5 of the India-Finland Double Taxation Treaty, a division bench of Justices Yashwant Varma and Ravinder Dudeja observed,“There is no general presumption in law that a subsidiary can never be acknowledged to be a PE. This since Article 5(8) itself merely states that the...

CBDT Cannot Impose Limitations To Extinguish Rights Granted Under Income Tax Act: Delhi High Court

Recently, the Delhi High Court held that Central Board of Direct Taxes (CBDT) cannot impose limitations to extinguish rights granted under Income Tax Act, 1961. The Court held that the wide powers granted to the CBDT are not for extinguishing a right that is conferred by the Act. Accordingly, the Court Circular No. 07/2007 dated 23 October 2007 issued by the CBDT to the be ultra vires the Income Tax Act.Circular No. 07/2007 dated 23 October 2007 issued by the Central Board of Direct Taxes...

Man Accused Of Taking ₹2 Crore Dowry Seeks Income Tax Dept Probe Into Wife's Family, Delhi High Court Rejects Plea

The Delhi High Court has rejected the writ petition filed by a man, seeking an inquiry into the finances of his wife and her family who claimed to have paid him ₹2 crores dowry, in addition to spending crores of rupees on their wedding.A division bench of Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela observed that the complaint stemmed from a matrimonial feud and the man was unable to indicate the provision under which such a complaint was made to the Income Tax...

Customs Authorities Can't Deny Benefit Of Customs Duty Exemption Under Notifications Governing Advance Licensing Scheme: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that the Customs authorities cannot deny the benefit of Customs duty exemption under the notifications governing the Advance Licensing Scheme. The Bench of Dr. Rachna Gupta (Judicial Member) and Hemambika R. Priya (Technical Member) was addressing the issue of whether the goods imported by the assessee under AAs are permitted for duty free import under Advance Authorization Scheme. In ...

Delhi High Court Quashes ₹2000 Crore Tax Reassessment Notice Against Maruti Suzuki For Alleged Escapement Of Income In AY 2009-10

The Delhi High Court has quashed the reassessment action initiated by the Income Tax Department against car manufacturer Maruti Suzuki India Ltd for alleged escapement of income in the Assessment Year 2009-10.A division bench of Justices Yashwant Varma and Ravinder Dudeja observed that the company had made full and true disclosure of all facts in the course of the assessment and the Department did not have jurisdiction to reopen the assessment under Sections 147/148 of the Income Tax Act,...

GST Act | Can Time Limit To Adjudicate Show Cause Notice Be Extended By Notification Under S.168A? Supreme Court To Consider

The Supreme Court is to decide whether the time limit for adjudicating show cause notice and passing an order can be extended by the issuance of notifications under Section 168-A of the GST Act. This provision empowers the Government to issue notification for extending the time limit prescribed under the Act which cannot be complied with due to force majeure.“The issue that falls for the consideration of this Court is whether the time limit for adjudication of show cause notice and passing order...

Appeal Can't Be Dismissed Due To Procedural Delay When Assessee Has Complied With Statutory Requirements Including Pre-Deposit: Madras HC

The Madras High Court stated that appeal can't be dismissed due to procedural delay, when assessee has complied statutory requirements including pre-deposit. “The appeal should not be dismissed merely due to a procedural delay, especially when the petitioner has made an effort to comply with the statutory requirements, including the pre-deposit of 10% of the tax liability and additional payments towards the disputed tax amount” stated the bench of Justice Vivek Kumar Singh. In ...

Tax Weekly Round-Up: February 17 - February 23, 2025

SUPREME COURTCharitable Trust's Registration For Income Tax Exemption To Be Decided Based On Proposed Activities & Not Actual Activities : Supreme CourtCase Title: COMMISSIONER OF INCOME TAX EXEMPTIONS VERSUS M/S INTERNATIONAL HEALTH CARE EDUCATION AND RESEARCH INSTITUTECase no.: SPECIAL LEAVE PETITION (CIVIL) Diary No. 19528/2018The Supreme Court reiterated that when a charitable trust registers under Section 12-AA of the Income Tax Act (“Act”) for income tax exemptions (under Sections 10...

If Goods Imported Into SEZ Are Not Used For Authorised Operations But Sold In Domestic Tariff Area, Duty Has To Be Paid: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that if goods imported into an SEZ are not used for the authorised operations but are sold in Domestic Tariff Area, duty has to be paid. Section 51 of the Special Economic Zones (SEZ) Act, 2005 states that the provisions of the SEZ Act will take precedence over any other conflicting laws, meaning that if there is a disagreement between the SEZ Act and another law, the SEZ Act will be the...