Tax

Enterprise Manufacturing Specified Items In Designated States Can Seek Tax Deduction U/S 80IC Income Tax Act Without Agreement With Govt: Delhi HC

The Delhi High Court has held that Section 80IC of the Income Tax Act, 1961, which contemplates tax incentives for enterprises operating in specific industries and locations in India, does not require such enterprises to enter into an agreement with the Government.In doing so, a division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar distinguished the provision from Section 80IA, whereunder agreement with the Centre, State or local authority is a pre-condition for claiming...

Reimbursements Received By Assessee Can't Be Considered As 'Consideration' Towards Any Taxable Service: CESTAT

The Kolkata Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that the reimbursements received by the assessee cannot be considered as 'consideration' towards any taxable service. The Bench of Ashok Jindal (President) and K. Anpazhakan (Technical) has observed that, “the service rendered by the appellant is not for any other company but to themselves. Thus, there is no service provider and service receiver relationship exists in the transaction.” In...

'Customs Officers' Are Not 'Police Officers', Must Satisfy Higher Threshold Of 'Reasons To Believe' Before Arrest : Supreme Court

Dealing with a challenge to penal provisions of the Customs Act, the Supreme Court today observed that 'customs officers' are not 'police officers' and that they must satisfy a higher threshold of "reasons to believe" before arresting an accused.A bench of CJI Sanjiv Khanna and Justices MM Sundresh, Bela M Trivedi made the observation while delivering verdict in a batch of 279 petitions challenging the penal provisions in the Customs Act, CGST/SGST Act, etc. as non-compatible with the CrPC and...

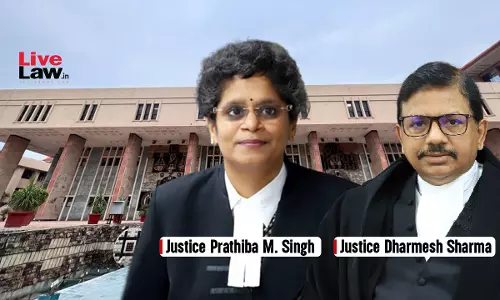

Customs Department's Baggage Rules Have 'Limited Application' On Foreign Tourists: Delhi HC Orders Release Of Russian National's Gold Chain

The Delhi High Court has held that the Baggage Rules 2016 which are framed under the Customs Act 1962 to ensure that every passenger entering India passes through a Customs check has limited application on foreign tourists coming to India.While holding so, a division bench of Justices Prathiba M. Singh and Dharmesh Sharma ordered the release of a Russian national's gold chain, valued at about Rs. 7 lakhs, which was confiscated by the Customs Department when he arrived in India.It observed, “It...

Department Retaining Balance Amount After Tax Demand Is Reduced Violates Article 14 & Article 265 Of Constitution: Jharkhand High Court

The Jharkhand High Court stated that retaining balance amount by department after the tax demand is reduced is violative of Article 14 & Article 265 of the constitution. The Division Bench of Chief Justice M.S. Ramachandra Rao and Justice Deepak Roshan observed that the department cannot retain the amounts deposited by the assessee pursuant to condition imposed by the appellate authority for stay of the assessment order and contend that there is no necessity to refund the same. ...

ITAT Cannot Perpetuate Ex-Parte Order: Bombay High Court Orders Tribunal To Grant Opportunity Of Hearing To Assessee Before Proceeding On Merits

The Bombay High Court has disapproved of the Income Tax Appellate Tribunal dismissing the appeal against an ex-parte order passed against a former employee of Pfizer Healthcare without providing him an opportunity of hearing.Stating that ITAT cannot “perpetuate” the ex-parte order, a division bench of Justices GS Kulkarni and Advait M. Sethna directed the Tribunal to hear the employee de novo, so far as his prayer for the grant of exemption under section 89 of the Income Tax Act, 1961 is...

Can't Presume Pending Investigation For Disqualification Under 'Sabka Vishwas Scheme' When Proof Of Service Of Notice Not Available: Delhi HC

The Delhi High Court recently granted relief to a trader whose application for availing the Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 over service tax dues was declined by the GST Department “without providing any reason”.A division bench of Justices Prathiba M. Singh and Dharmesh Sharma observed that in the absence of proof of service of notice upon the trader, prior to his making an application for dispute resolution, it cannot be presumed that any investigation was pending...

Anticipatory Bail Application Maintainable Against Arrest Under GST Act : Supreme Court Overrules Its Previous Judgments

The Supreme Court has overruled its previous decisions which held that anticipatory bail applications were not maintainable with respect to offences under the Goods and Services Tax Act.A three-judge bench comprising Chief Justice of India Sanjiv Khanna, Justice MM Sundresh and Justice Bela Trivedi overruled the two-judge bench judgments in State of Gujarat v. Choodamani Parmeshwaran Iyer and Another and Bharat Bhushan v. Director General of GST Intelligence, Nagpur Zonal Unit Through Its...

Assessee Not Eligible To Avail CENVAT Credit On Invoices Not In Their Name: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that the assessee is not eligible to avail the CENVAT Credit on the basis of the invoices which were not in their name. The Bench of Binu Tamta (Judicial Member) and Hemambika R. Priya (Technical Member) has observed that “it is necessary that the document contains all particulars as mentioned therein to avail the credit. The name of the consignee or service receiver on the invoice is the...

Supply Of Holographic Stickers By Prohibition & Excise Dept For Affixing On Alcohol Bottles Is Supply Of “Goods”, Not Taxable: Madras High Court

The Madras High Court has recently observed that the supply of holographic stickers or excise labels by the Prohibition and Excise Department which is to be affixed on manufactured and bottles alcoholic liquor is a supply of “goods” simplicitor and not a supply of “service”. The court thus ruled that such supply of holographic stickers would not be taxable under the GST enactments. Justice C Saravanan noted that the holographic sticker was a label and therefore a good within the ...