Supreme Court

'Customs Officers' Are Not 'Police Officers', Must Satisfy Higher Threshold Of 'Reasons To Believe' Before Arrest : Supreme Court

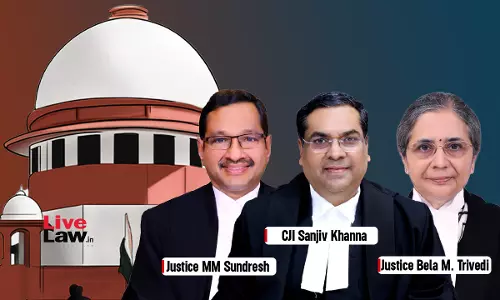

Dealing with a challenge to penal provisions of the Customs Act, the Supreme Court today observed that 'customs officers' are not 'police officers' and that they must satisfy a higher threshold of "reasons to believe" before arresting an accused.A bench of CJI Sanjiv Khanna and Justices MM Sundresh, Bela M Trivedi made the observation while delivering verdict in a batch of 279 petitions challenging the penal provisions in the Customs Act, CGST/SGST Act, etc. as non-compatible with the CrPC and...

MSME Act | Procurement Order 2012 Has Force Of Law, Authorities Subject To Judicial Review : Supreme Court

The Supreme Court recently (on February 25) held that the Procurement Order 2012 issued as per the Micro, Small and Medium Enterprises Development Act, 2006, has the force of law and is enforceable.The Court further held that while the MSME Act and the Procurement Order 2012 do not create an 'enforceable right' for an individual MSE, the statutory authorities and administrative bodies created thereunder are impressed with enforceable duties. They are accountable and subject to judicial...

Anticipatory Bail Application Maintainable Against Arrest Under GST Act : Supreme Court Overrules Its Previous Judgments

The Supreme Court has overruled its previous decisions which held that anticipatory bail applications were not maintainable with respect to offences under the Goods and Services Tax Act.A three-judge bench comprising Chief Justice of India Sanjiv Khanna, Justice MM Sundresh and Justice Bela Trivedi overruled the two-judge bench judgments in State of Gujarat v. Choodamani Parmeshwaran Iyer and Another and Bharat Bhushan v. Director General of GST Intelligence, Nagpur Zonal Unit Through Its...

Some Merit In Allegations That GST Officials Coerce Assesses To Pay Tax With Threat Of Arrest; It's Impermissible: Supreme Court

The Supreme Court on Thursday (February 27) observed that there was some merit in the allegation that tax officials coerce assesses to pay the Goods and Services Tax with the threat of arrest. This observation was made by the Court on the basis of data.The Court said that if any person is feeling coerced to pay GST, they can approach the writ court for refund of the tax paid by them under coercion. The Court also said that the officers who indulge in such coercion must be dealt with...

GST Act | Can Time Limit To Adjudicate Show Cause Notice Be Extended By Notification Under S.168A? Supreme Court To Consider

The Supreme Court is to decide whether the time limit for adjudicating show cause notice and passing an order can be extended by the issuance of notifications under Section 168-A of the GST Act. This provision empowers the Government to issue notification for extending the time limit prescribed under the Act which cannot be complied with due to force majeure.“The issue that falls for the consideration of this Court is whether the time limit for adjudication of show cause notice and passing order...

Supreme Court Disapproves Of High Court Interdicting Insolvency Process Against Personal Guarantor At Threshold Stage In Writ Jurisdiction

The Supreme Court while deciding an appeal pertaining to insolvency proceedings initiated against a personal guarantor, observed that the High Court should not have prohibited such proceedings by holding that the guarantor's liability has been waived. “It is well-settled that when statutory tribunals are constituted to adjudicate and determine certain questions of law and fact, the High Courts do not substitute themselves as the decision-making authority while exercising judicial review.,” the...

Benefit Of Input Tax Credit Can't Be Reduced Without Statutory Sanction : Supreme Court

The Supreme Court recently held that Rule 21(8) of the Punjab Value Added Tax Rules, 2005, which was notified on January 25, 2014, could not be applied to transactions before April 1, 2014, as the enabling amendment to Section 13 of the parent statute, the Punjab Value Added Tax Act, 2005, was effective from that date.This means businesses that bought goods at a higher tax rate before this date are not subject to the limitation imposed by Rule 21(8) when claiming ITC, even if the tax rate was...

Charitable Trust's Registration For Income Tax Exemption To Be Decided Based On Proposed Activities & Not Actual Activities : Supreme Court

The Supreme Court reiterated that when a charitable trust applies under Section 12-AA of the Income Tax Act (“Act”) for income tax exemptions (under Sections 10 and 11), the tax authorities should decide on the registration based on the charity's "proposed activities" than its actual activities, as stated in the Ananda Social case. The Court, however, clarified that mere registration under Section 12-AA would not entitle a charitable trust to claim exemption under Sections 10 and 11...

Income Tax Act | No Penalty Under S.271AAA If Undisclosed Income Is Admitted, Explained & Tax Paid Even With Delay : Supreme Court

The Supreme Court, while determining a tax matter, observed that the undisclosed income, under Section 271AAA(1) of the Income Tax Act, surrendered by the assessee during the search, is not sufficient to levy the penalty. Essentially, the said provision talks about penalty where a search has been initiated. The explanation reads as: “(a) “Undisclosed income” means— (i) any income of the specified previous year represented, either wholly or partly, by any money, bullion, jewellery or...

'Every Statute Prima Facie Prospective Unless Stated Otherwise' : Supreme Court Says 2002 Amendment To CST Act Won't Affect Accrued Rights

The Supreme Court yesterday (on February 12) held that though after the amendment of Section 8(5) of the Central Sales Tax Act, the State Government's right to grant exemption from tax has ceased to exist, the amendment is prospective. Thus, it would not apply to the cases where an absolute exemption has already been granted.The amended Act nowhere stipulates that rights previously accrued stand nullified or all previous exemptions stand cancelled or revoked., the Bench of Justices P.S....