Tax

Is Merchant Navy Officer's Salary Credited In Indian Bank Account Exempt From Income Tax? Supreme Court To Decide

The Supreme Court on Monday (Aug. 18) agreed to decide whether the income credited in an Indian bank account while working with a Foreign Entity would be exempted from the payment of Income Tax under the Income Tax Act, 1961.. The issue arose before the bench of Justices Pankaj Mithal and Prasanna B. Varale while hearing the appeal filed against the Punjab & Haryana High Court's decision upholding the Motor Accident Claims Tribunal (“MACT”) decision to deduct 30% towards tax liability while...

Widow Eligible To Claim TDS Credit On Deceased Husband's Income: ITAT

The Kolkata Bench of Income Tax Appellate Tribunal (ITAT) has stated that widow eligible to claim TDS credit on deceased husband's income. Sonjoy Sarma (Judicial Member) and Rakesh Mishra (Accountant Member) stated as per sub-rule (2) of Rule 37BA and sub-rule 3(i) of the Income Tax Rules, 1962, if the income is assessable in the hands of any other person, the credit of TDS shall be given to him for the year in which the income is shown. In this case, after husband's death, the...

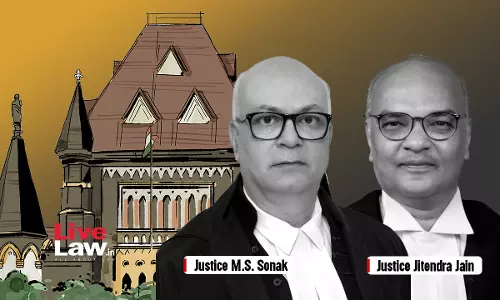

Bank Guarantee Which Expired Almost Ten Years Before CIRP Was Initiated, Cannot Be Enforced: Bombay High Court

The Bombay High Court stated that expired bank guarantee can't be enforced post CIRP (corporate insolvency resolution process). Justices M.S. Sonak and Jitendra Jain stated that, “The argument that a personal guarantee survives the CIRP does not apply in the case because the guarantee had expired even before the CIRP. During the validity period of the guarantee, admittedly, no claim was lodged by the department. This petition was instituted almost 10 years after the guarantee expired,...

Tax Weekly Round-Up: August 11 - August 17, 2025

SUPREME COURTS.6(2)(b) CGST Act | Central Authority Can Issue Summons Despite State Authority Initiating Proceedings : Supreme CourtCause Title: M/S ARMOUR SECURITY (INDIA) LTD. VERSUS COMMISSIONER, CGST, DELHI EAST COMMISSIONERATE & ANR.In a significant ruling, the Supreme Court on Thursday (Aug. 14) held that a summons issued by the Central GST authorities under Section 70 of the Goods and Services Tax Act does not constitute “initiation of proceedings" under Section 6(2)(b) of the CGST...

Limitation To Claim GST Refund Begins From Date Of Correct Tax Payment: Patna High Court

The Patna High Court held that limitation for GST refund in wrong head ceases computed from correct payment date. Justices Rajeev Ranjan Prasad and Shailendra Singh after reading Section 77 of the CGST Act, 2017 read with Section 19 of the IGST Act opined that the relevant date for counting the period of limitation would start from the date when the assessee had deposited the tax under IGST Act. It is the case of the petitioner/assessee that for the financial year 2017-18, the ...

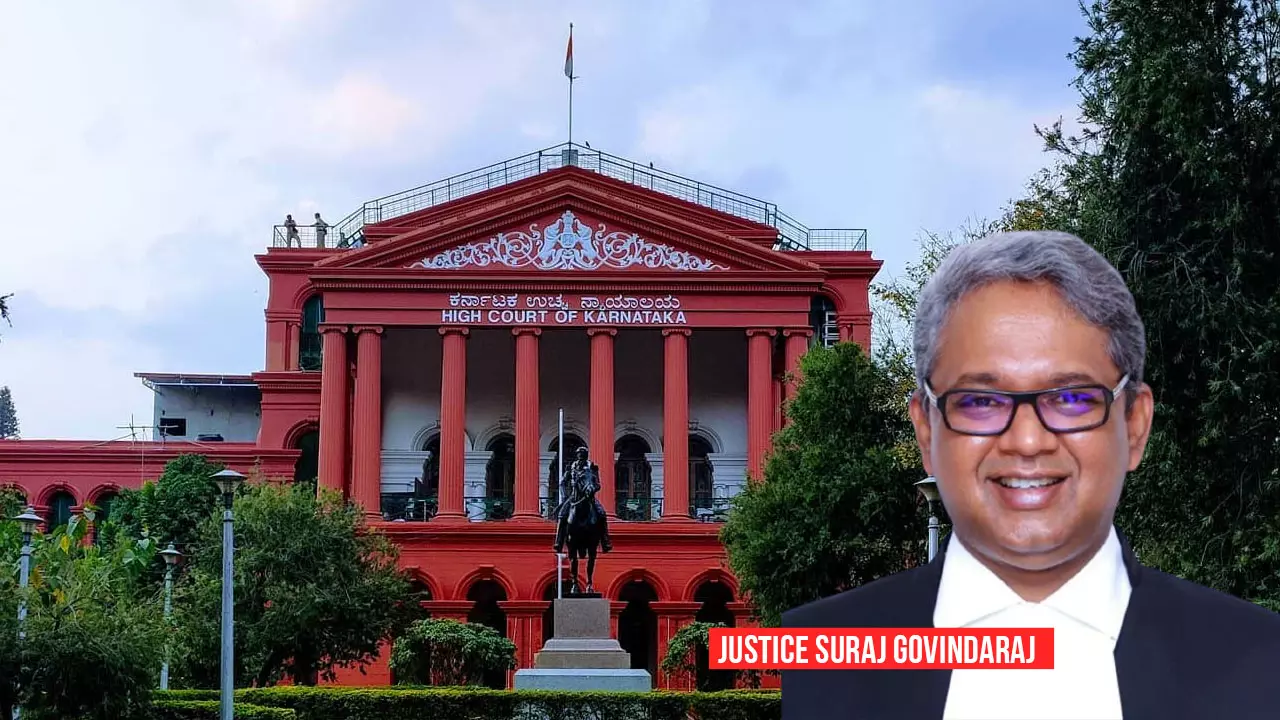

Export Incentives Can't Be Denied For Inadvertent Error In Shipping Bill: Karnataka High Court

The Karnataka High Court held that export incentives can't be denied for inadvertent error in shipping bill. The bench opined that …..there are situations where the assessee by inadvertence or even otherwise has uploaded certificate/forms or returns which contains some errors which would require correction. The said correction or amendment cannot be denied on the basis of the technological system which has been introduced by the Department to contend that the software does not allow...

No Sales Tax On HDPE Bags Used To Pack Cement When Sold Separately: Bombay High Court

The Bombay High Court stated that no sales tax can be levied on HDPE (High-Density Polyethylene) bags at cement rate when sold separately. Justices M.S. Sonak and Jitendra Jain were addressing the issue of whether there is an express and independent contract on the sale of HDPE bags in which cement is packed. “HDPE bags used to pack the cement were a distinct commodity with its own identity and were classified separately. There was no chemical or physical change in the packing...

[S.169 CGST Act] Service On Registered Email Is Sufficient For Calculating Limitation Period: Allahabad High Court

The Allahabad High Court has held that under Section 169 of the Central Goods and Service Tax Act, 2017 service on registered email is sufficient service for the purpose of limitation. It held that holding that service was to be made by more than one modes would be absurd and defeat the purpose of the provision. The bench of Justice Shekhar B. Saraf and Justice Praveen Kumar Giri held “Upon perusal of Section 169 of the Act, we are of the view that in the event the service is made by...

Consideration Paid To Foreign Company For Use Of Computer Software Not 'Royalty', No TDS Liability: Delhi High Court

The Delhi High Court has reiterated that consideration paid by an Indian entity to a foreign company for the resale/ use of their computer software is not 'royalty'.A division bench of Justices V. Kameswar Rao and Vinod Kumar thus held that the Indian entity is not liable to deduct TDS in such cases.The bench in this regard relied on Engineering Analysis Centre of Excellence Pvt. Ltd. v. The Commissioner of Incometax & Another (2021) where the Supreme Court had held that amounts paid by...

No Service Tax On Catering Services Provided To Educational Institutions: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that no service tax on catering services provided to educational institutions. Dr. Rachna Gupta (Judicial Member) and Hemambika R. Priya (Technical Member) were addressing the issue of whether the catering services provided by the assessee to a School with hostel facility are covered under the exemption from payment of service tax given at serial no.9 of Notification No.25/2012-ST dated...

`Tribunal Has Inherent Authority To Stay Orders Detrimental To Revenue: CESTAT

The Chennai Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that tribunal has inherent authority to stay orders detrimental to revenue. P. Dinesha (Judicial Member) and M. Ajit Kumar (Technical Member) stated that “the power of taxation including its collection being an inherent attribute of sovereignty, the right of revenue to seek a stay of an order determinantal to the collection of taxes, cannot be lightly dismissed….……..we find force in the plea...

![[S.169 CGST Act] Service On Registered Email Is Sufficient For Calculating Limitation Period: Allahabad High Court [S.169 CGST Act] Service On Registered Email Is Sufficient For Calculating Limitation Period: Allahabad High Court](https://www.livelawbiz.com/h-upload/2024/08/16/500x300_556088-gst.webp)