Tax

Sections 43B & 40A Income Tax Act | Which Provision Prevails When Both Commence With Non-Obstante Clause? Madras High Court Clarifies

The Madras High Court while referring sections 43B and 40A Income Tax Act explained which provision prevails when both commence with a non-obstante clause. The Division Bench of Justices Dr. Anita Sumanth and G. Arul Murugan stated that “the Rule that a general provision should yield to specific provision springs from the common understanding that when two directions are given one encompassing a large number of matters in general and another to only some, the latter directions should...

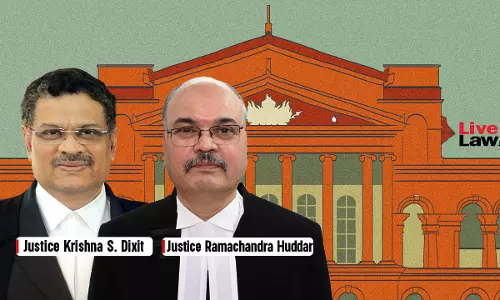

Inflating Contract Figures & Complaining That Tax Authorities Based Decision On Such Figures Amounts To Defrauding State In Two Ways: Karnataka HC

The Karnataka High Court stated that inflating contract figures and complaining that tax authorities have premised their decision on such figures, amounts to defrauding state. “Claiming higher contract amount by inflated figures and thereafter complaining that the Tax authorities have premised their decision on such figures, virtually amounts to defrauding the State, in two-ways. Such an assessee does not deserve any relief at the hands of this Court,” stated the Division Bench of...

Delhi High Court Grants Relief To Lufthansa Airlines, Sets Aside Revenue's Order Denying 'Nil' TDS Certificate

In a relief to German cargo airline Lufthansa, the Delhi High Court set aside the Revenue's order denying nil TDS certificate to the company for the financial year 2024-25.Section 195 of the Income Tax Act, 1961 deals with the deduction of TDS (Tax Deducted at Source) on payments made to non-resident Indians (NRIs). However, 'nil' withholding tax certificates can be issued under Section 195(3), subject to prescribed conditions.Accordingly, Lufthansa moved an application before the Revenue for...

Tax Weekly Round-Up: March 24 - March 30, 2025

SUPREME COURT'Timelines To Rectify Bonafide GST Form Errors Must Be Realistic' : Supreme Court Asks CBIC To Re-examine ProvisionsCase title : CENTRAL BOARD OF INDIRECT TAXES AND CUSTOMS v. M/S ABERDARE TECHNOLOGIES PRIVATE LIMITED & ORS.Case no.: SPECIAL LEAVE PETITION (CIVIL) Diary No. 6332/2025The Supreme Court recently underscored the need for the Central Board of Indirect Taxes and Customs to fix realistic timelines for correcting bonafide errors by the assesses in forms when filing GST...

Relationship Between Searched And Non-Searched Entity Not Mandatory For Invocation Of Proceedings U/S 153C Income Tax Act: Delhi High Court

The Delhi High Court has held that the statutory scheme of Sections 153A and 153C of the Income Tax Act, 1961 does not envisage the discovery of a connection or interrelationship between the searched and the non-searched entity.Section 153A deals with the procedure for assessment which may be set in motion in respect of an entity searched under Section 132 of the Act. Upon such a search being conducted, the AO of the searched person is statutorily enabled to issue notice to the searched entity...

“Completely Unacceptable”: Delhi High Court Pulls Up Customs For Prolonged Detention Of Export Goods Despite Dept's Circular

The Delhi High Court has criticised the Customs Department for acting against its own Circular for expeditious clearance of goods, by detaining the export goods of a trader for over two months.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed, “This position is completely unacceptable to the Court…consignment cannot be held up in this manner…expedited steps are not taken for clearing of goods.”Petitioner's export consignment of 'ladies PVC slippers' was put on hold...

Delhi High Court Slams CBIC For Cryptic Order Denying Duty Drawbacks To Vedanta Despite Its Own Instructions Allowing Retrospective Benefit

The Delhi High Court has asked the Central Board of Indirect Taxes and Customs to pass a “reasoned order” on Indian multinational mining company- Vedanata's plea claiming duty drawbacks on clean energy cess, paid between the year 2010-17.The plea was rejected by CBIC through a “cryptic order” citing limitation despite its own Instruction clearing air on eligibility of drawbacks on clean energy cess, with retrospective benefit to pending cases, a division bench of Justices Prathiba M. Singh and...

Student Almanac And Teacher Planner Not Exigible To Excise Duty: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that Student Almanac and teacher planner not exigible to excise duty. The Bench of Justice Dilip Gupta (President) and P.V. Subba Rao (Technical Member) has observed that the submission of the assessee that since Student Almanac is used only by students of a particular school, it becomes a product of printing industry cannot be accepted. In this case, the issue in dispute is regarding the...

Non-Payment Of Service Tax By Sub-Contractor Due To Uncertainity Not Wilful Misstatement Or Fraud: Delhi HC Upholds CESTAT Order

The Delhi High Court has upheld an order of the Customs Excise and Service Tax Appellate Tribunal interdicting the GST Department from invoking extended period of limitation for recovery action against a sub-contractor who did not pay service tax amid confusion as to his liability to pay the same.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta upheld the CESTAT order which held that bonafide belief of the sub-contractor that he was not required to discharge service tax...

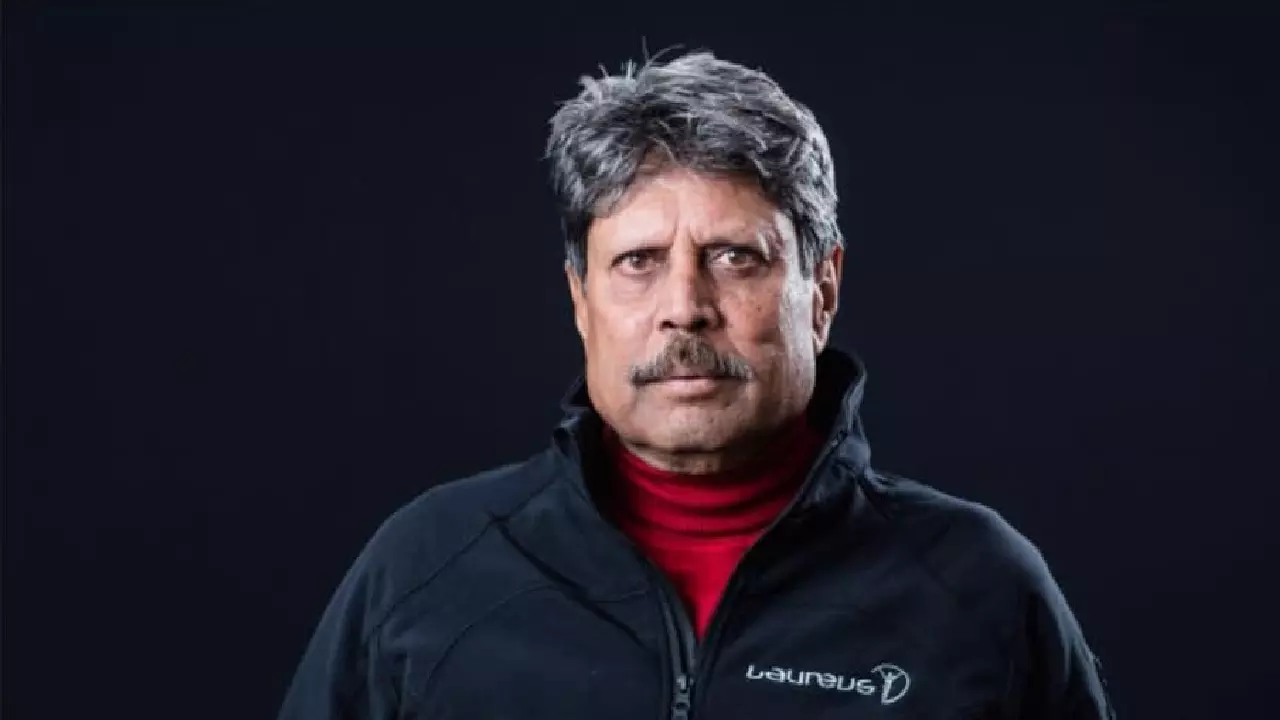

ITAT Exempts Tax On ₹1.5 Crore Granted By BCCI To Kapil Dev In Recognition Of His Services To Cricket

The Income Tax Appellate Tribunal at Delhi allowed renowned cricketer Kapil Dev to claim exemption on Rs. 1.5 crore one-time benefit granted to him by the BCCI in 2013, in recognition of his services.Noting that the cricketer had offered the amount for tax under ignorance, bench of M. Balaganesh (Accountant Member) and MS Madhumita Roy (Judicial Member) said,“It is trite law that right amount of tax should be collected from the right person in accordance with law. Article 265 of the...

Supreme Court Issues Notice In Challenge To West Bengal Taxes On Entry Of Goods Act

The Supreme Court is set to examine the constitutional validity of the West Bengal Taxes on Entry of Goods into the Local Areas Act, 2012, as amended by the West Bengal Finance Act, 2017, along with related Rules and notifications.A bench of Justice JB Pardiwala and Justice R Mahadevan recently issued notice returnable on April 22, 2025 in a batch of petitions challenging the constitutional validity of the Act. The Finance Act amended various provisions of the Entry Tax Act with retrospective...

Customs Can Clone Data Of Seized Electronic Devices As Per Statutory Procedure, Need Not Retain Devices Throughout Prosecution: Delhi HC

The Delhi High Court has called upon the Customs Department to clone the required data from seized electronic devices of persons allegedly involved in smuggling and other violations under the Act, instead of retaining such devices throughout prosecutions.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed that such a practice will not only ensure that the Department does not lose the data due to the seized device getting outdated but it will also provide make the...