SERVICE TAX

Service Charge Collected By Medical Store In Hospital Covered Under “Health Care Services”, Exempted From Service Tax: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that service charge collected by a medical store in the hospital is covered under “Health Care Services” and are exempted from Service Tax. The Bench of Binu Tamta (Judicial Member) has observed that “medical aid to the patients who are admitted in the hospital, most of the time requires urgent care and treatment without any loss of time and that is the reason for having a medical store...

No Service Tax Can Be Determined Without Clarifying The Category Of Service Under Which The Said Amount Can Be Attributed: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that no service tax can be determined without clarifying the category of service under which the said amount can be attributed. Under Section 78 of the Finance Act, 1994, if service tax has not been levied, paid, short-levied, short-paid, or erroneously refunded due to fraud, collusion, willful misstatement, suppression of facts, or contravention with the intent to evade payment, the person...

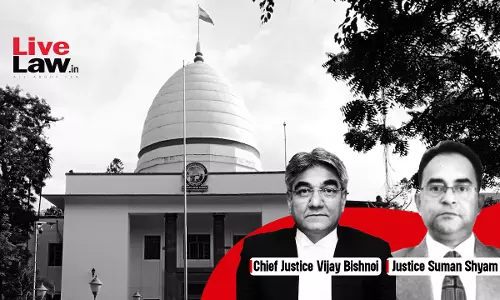

No Element Of Misstatement And Intention To Evade Payment Of Service Tax: Gauhati High Court Quashes Demand & Penalty

Finding that the Assessee company had provided every detail regarding availment of CENVAT Credit in the ST-3 Returns, and the same was considered by the Central Excise Commissioner, the Gauhati High Court held that the fact of wilful misstatement or suppression should specifically be mentioned in the show-cause notice. Since the Department had not misstated any fact with intent to evade the payment of service tax, the Division Bench of Chief Justice Vijay Bishnoi and Justice Suman...

Tax Invoice, E-Way Bill, GR Or Payment Details Not Sufficient To Prove Physical Movement Of Goods: Allahabad High Court Upholds Penalty U/S 74 GST

Recently, the Allahabad High Court has held that production of tax invoice, e-way bill, GR or payment details is not sufficient to show the actual physical movement of the transaction for the purposes of availing Input Tax Credit under Section 16 of the Goods and Service Tax Act, 2017. Section 16 of the Goods and Service Tax Act, 2017 provides for the conditions and eligibility for claiming input tax credit. Section 16(2) provides that an assesee is not entitled any input tax credit...

Preferential Location Charges Charged By Builder Includible In Taxable Value For Service Tax Levy: CESTAT

The Allahabad Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that the preferential location charges charged by the builder includible in the taxable value of the service tax levy.The bench of P.K. Choudhary (Judicial Member) and Sanjiv Srivastava (Technical Member) have observed that the service is rendered in the context of a location, which does not make it a tax on land within the meaning of Entry 49 of List II. The tax continues to be a tax on the rendering of...

Service Tax Not Payable On Revenue Sharing Arrangement Between Exhibitors & Distributors Of Films: CESTAT

The Mumbai Bench of Customs, Excise, and Service Tax (CESTAT) has held that the no service tax is payable on revenue sharing arrangements between exhibitors and distributors of films.The bench of Justice Dilip Gupta (President) and C. J. Mathew (Technical Member) has observed that the theatre owner screens or exhibits a movie that has been provided by the distributor. Such an exhibition is not a support or assistance activity but is an activity of its own accord. The activity cannot fall under...

No Service Tax Payable On Clinical Trial On Drugs Supplied By Foreign Service Recipient: CESTAT

The Ahmedabad Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has observed that no service tax is payable on the activity of clinical trials on the drugs supplied by the foreign service recipient.The bench of Ramesh Nair (Judicial Member) and C.L. Mahar (Technical Member) has observed that the activity of clinical trials on the drugs supplied by the foreign service recipient to the appellant amounts to export of service.During the course of the audit of the appellant's...

Commission Deducted In Sale Invoice To Foreign Buyer Is Not Chargeable To Service Tax: CESTAT

The Ahmedabad Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that the commission deducted in the sale invoice of the appellant to their foreign buyer is not chargeable to service tax.The bench of Ramesh Nair (Judicial Member) and C.L. Mahar (Technical Member) has observed that there is no contract between the appellant and the foreign-based service provider, even if any arrangement of payment is there between the buyer of the goods and the so-called commission...

Arranging Package Tour Can't Be Classified As Tour Operator Service, No Service Tax Payable: CESTAT

The Ahmedabad Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that no service tax is payable on arranging package tours.The bench of Ramesh Nair (Judicial Member) and C.L. Mahar (Technical Member) has observed that the service cannot be classified under Tour Operator Service as arranging the package tour does not involve all the activities that are required to classify the service under Tour Operator Service.The appellant/assessee has submitted that business...

Goods In Transit Without Documents, Can Survey Business Premises To Find Correctness Of Transaction: Allahabad High Court

The Allahabad High Court has held that if the goods in transit are not accompanied by proper documentation, including e-way bill, the authorities can survey the business premises of the assesee to determine the correctness of the transaction. However, it was held that if the e-way bill was produced before passing of seizure order under Section 129 of the Goods and Service Tax Act, 2017, then contravention of the Act or Rules thereunder could not be claimed by the Department. While...

No Service Tax Payable On Laying Down Water Supply Pipelines For Govt.: CESTAT

The Kolkata Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that the assessee is not liable to pay service tax for the activity undertaken by them for laying down the pipelines for government/government undertakings for supply of water from KWA in Thiruvananthapuram City. The bench of Ashok Jindal (Judicial Member) and K. Anpazhakan (Technical Member) has observed that the construction of canals/pipelines/conduits to support irrigation, water supply, or sewerage...

CESTAT Quashes SCN Issued Against Fruit Seller Not Engaged In Any Service Tax Leviable Activity

The Mumbai Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has quashed the show cause notice issued against fruit sellers who are not engaged in any service tax-leviable activity.The bench of Suvendu Kumar Pati (Judicial Member) and Anil G. Shakkarwar (Technical Member) has observed that the show cause notice did not establish that the appellant was providing any service. The show cause notice was sent to some address in Navi Mumbai, whereas the appellant is conducting his...