INCOME TAX

Is Merchant Navy Officer's Salary Credited In Indian Bank Account Exempt From Income Tax? Supreme Court To Decide

The Supreme Court on Monday (Aug. 18) agreed to decide whether the income credited in an Indian bank account while working with a Foreign Entity would be exempted from the payment of Income Tax under the Income Tax Act, 1961.. The issue arose before the bench of Justices Pankaj Mithal and Prasanna B. Varale while hearing the appeal filed against the Punjab & Haryana High Court's decision upholding the Motor Accident Claims Tribunal (“MACT”) decision to deduct 30% towards tax liability while...

Widow Eligible To Claim TDS Credit On Deceased Husband's Income: ITAT

The Kolkata Bench of Income Tax Appellate Tribunal (ITAT) has stated that widow eligible to claim TDS credit on deceased husband's income. Sonjoy Sarma (Judicial Member) and Rakesh Mishra (Accountant Member) stated as per sub-rule (2) of Rule 37BA and sub-rule 3(i) of the Income Tax Rules, 1962, if the income is assessable in the hands of any other person, the credit of TDS shall be given to him for the year in which the income is shown. In this case, after husband's death, the...

Income Tax | Interest Earned On Surplus Lending Funds Is Attributable To Banking Business, Qualifies For 80P Deduction: Calcutta High Court

The Calcutta High Court stated that interest earned on surplus lending funds is attributable to banking business, qualifies for 80P deduction under Income Tax Act. Section 80P of the Income Tax Act, 1961 provides 100% tax deductions to cooperative societies for income from specified activities. These activities commonly include marketing agricultural produce, purchasing agricultural supplies, processing products without power, offering banking services, and more. Chief Justice T.S....

Income Tax Act | Criminal Complaint For Tax Evasion Filed During Pendency Of Reassessment Proceedings Not Premature: Delhi High Court

The Delhi High Court recently dismissed a plea for quashing a criminal complaint lodged under Income Tax Act 1961 for alleged tax evasion, moved on the ground that reassessment action was pending and hence the complaint was premature.The bench of Justice Neena Bansal Krishna cited P. Jayappan vs. S.K. Perumal, First Income Tax Officer [1984] where it was held that pendency of re-assessment proceedings cannot act as a bar to the institution of criminal prosecution for the offences under Section...

Income Tax Act | Supreme Court Delivers Split Verdict On Timelimit For Assessments Under S.144C

The Supreme Court on Friday (Aug. 8) delivered a split verdict on the interpretation of the limitation period under Section 144C of the Income Tax Act, 1961 (“Act”), governing the timeline for passing assessment orders by the Assessing Officer in cases involving eligible assessees, such as foreign companies and transfer pricing matters.The judgment was delivered by the bench of Justices BV Nagarathna and SC Sharma.In a split verdict, Justice BV Nagarathna ruled that Section 153(3)'s...

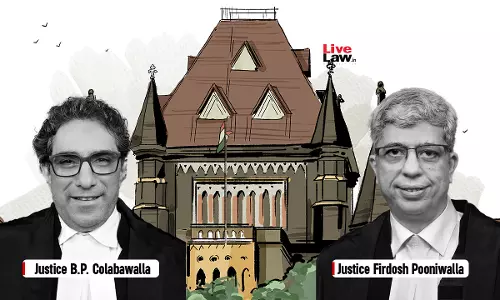

Income Tax | S.194C & S.194LA Would Not Apply When TDR Certificates Are Issued In Lieu Of Compensation: Bombay High Court

The Bombay High Court held that Section 194C and Section 194LA of the Income Tax Act would not apply when TDR Certificates are issued in lieu of compensation. Justices B.P. Colabawalla and Firdosh P. Pooniwalla agreed with the assessee that the words “or by any other mode” appearing in Section 194C would have to be read ejusdem generis to the words “payment thereof in cash or by issue of a cheque or draft”. Similarly, in Section 194LA, the words “or by any other mode” would have to...

Stock Exchange & Banking Channels Cannot Mask Sham Transactions Carried Out Through Bogus Capital Loss Claim Companies: Calcutta High Court

The Calcutta High Court held that stock exchange and banking channels cannot mask sham transactions carried out through bogus capital loss claim companies. Justices T.S. Sivagnanam and Chaitali Chatterjee (Das) observed that “the entire information contained in the investigation report was apprised to the assessee by the assessing officer and thereafter the show cause notices was issued for which the assessee' submitted their reply and in the reply they did not raise any issue that...

Mere Incorporation Of Investing Companies Under Companies Act Not Enough To Prove Genuineness Of Share Transactions: Calcutta High Court

The Calcutta High Court held that mere incorporation of investing companies under the Companies Act is not enough to prove the genuineness of share transactions. The bench opined that, admittedly, the shares were by way of a private placement. Though the investing companies might have been incorporated under the provisions of the Company's Act, that by itself will not validate the transaction. Justices T.S. Sivagnanam and Chaitali Chatterjee (Das) stated that “though it can be...

Income Tax | Sale Proceeds Of One House Used For Purchasing Multiple Residential Houses Qualifies For Exemption U/S 54(1): Bombay High Court

The Bombay High Court held that sale proceeds of one residential house, used for purchase of multiple residential houses, would qualify for exemption under Section 54(1) of the Income Tax Act. The issue before the bench was whether Section 54(1) of the Income Tax Act allows the Assessee to set off the purchase cost of more than one residential units against the capital gains earned from sale of a single residential house. Chief Justice Alok Aradhe and Justice Sandeep V. Marne stated...

Burden To Prove That Best Assessment By Income Tax Authorities Is Perverse Is On Assesee: Allahabad High Court

The Allahabad High Court has held that the burden to prove that the findings of best assessment done by the authorities is perverse is on the assesee. The bench of Justice Shekhar B. Saraf and Justice Praveen Kumar Giri held that “when a best assessment is done, it is for the assessee to bring on record the facts that may reveal that the findings are perverse in nature.” Appellant filed the Income Tax Appeal against the order of the Income Tax Appellate Tribunal who upheld the...

Foreign Entity Doing Business Through Temporary Premises In India Liable To Tax : Supreme Court Rejects Hyatt International's Appeal

The Supreme Court on Thursday (July 24) ruled that the existence of a Permanent Establishment (PE) is sufficient to attract tax liability for a foreign entity in India, even in the absence of exclusive possession of a fixed place of business. The Court clarified that temporary or shared use of premises, when combined with administrative or operational control, is adequate to establish a PE, thereby triggering income tax liability in India.Holding so, the bench comprising Justice J.B. Pardiwala...

Unauthenticated Documents From Foreign Govt Regarding Swiss Bank Account Of Assessee Can't Form Basis For Criminal Action: Delhi HC

The Delhi High Court has quashed the criminal proceedings initiated against an assessee under Section 276C, 276D and 277 of the Income Tax Act 1961 merely on the basis of some unauthorised documents alleging existence of an undisclosed Swiss Bank account in his name.In doing so, Justice Neena Bansal Krishna observed,“Merely on some unauthenticated information received from a third Country with no material evidence, is not sufficient to make out a prima facie case and there cannot be a...