CUSTOMS

S.67 Of CGST Act & S.110 Of Customs Act Are Pari Materia; GST Department Must Give Notice To Assessee Before Extending Seizure Period: Delhi HC

The Delhi High Court has held that an assessee must be issued notice within six months of seizure of its goods under Section 67 of the Central Goods and Services Tax Act 2017, failing which the goods must be returned by the Department.A division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar further held that the period of seizure cannot be extended under Section 67)7) for a further six-month period without giving notice to the accused.This, as the Court found the provision to...

'Highly Undesirable Practice, Wastes Judicial Time': Delhi High Court Laments Frequent Non-Appearance Of Govt Counsel In Customs Matters

The Delhi High Court recently expressed its displeasure at the frequent non-appearance of government counsel in customs related matters.A division bench comprising Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed, “It is noticed that in a large number of customs matters, the Counsels are either not appearing or appear without proper instructions. In cases of nonappearance, the Court is compelled to request Standing Counsels present in Court to accept notice. This reflects a clear...

'Extra Duty Deposit' Different From Customs Duty, Limitation For Seeking Refund U/S 27 Of Customs Act Is Inapplicable: Delhi High Court

The Delhi High Court has held that an Extra Duty Deposit (EDD) does not constitute a payment in the nature of customs duty under the scope of Section 27 of the Customs Act, 1962 and thus, the period of limitation for seeking a refund of customs duty under the provision would not apply qua EDD.Section 27 deals with a person/entity's claim for a refund of Customs duty in certain circumstances.A division bench of Justices Prathiba M. Singh and Dharmesh Sharma observed, “A perusal of Section 27...

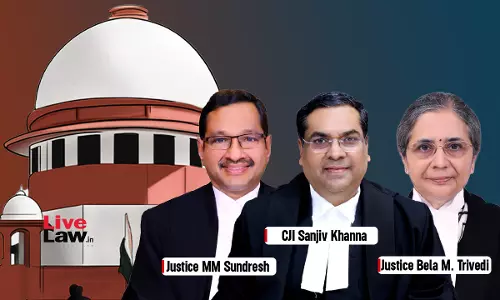

'Customs Officers' Are Not 'Police Officers', Must Satisfy Higher Threshold Of 'Reasons To Believe' Before Arrest : Supreme Court

Dealing with a challenge to penal provisions of the Customs Act, the Supreme Court today observed that 'customs officers' are not 'police officers' and that they must satisfy a higher threshold of "reasons to believe" before arresting an accused.A bench of CJI Sanjiv Khanna and Justices MM Sundresh, Bela M Trivedi made the observation while delivering verdict in a batch of 279 petitions challenging the penal provisions in the Customs Act, CGST/SGST Act, etc. as non-compatible with the CrPC and...

Customs Department's Baggage Rules Have 'Limited Application' On Foreign Tourists: Delhi HC Orders Release Of Russian National's Gold Chain

The Delhi High Court has held that the Baggage Rules 2016 which are framed under the Customs Act 1962 to ensure that every passenger entering India passes through a Customs check has limited application on foreign tourists coming to India.While holding so, a division bench of Justices Prathiba M. Singh and Dharmesh Sharma ordered the release of a Russian national's gold chain, valued at about Rs. 7 lakhs, which was confiscated by the Customs Department when he arrived in India.It observed, “It...

Customs Authorities Can't Deny Benefit Of Customs Duty Exemption Under Notifications Governing Advance Licensing Scheme: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that the Customs authorities cannot deny the benefit of Customs duty exemption under the notifications governing the Advance Licensing Scheme. The Bench of Dr. Rachna Gupta (Judicial Member) and Hemambika R. Priya (Technical Member) was addressing the issue of whether the goods imported by the assessee under AAs are permitted for duty free import under Advance Authorization Scheme. In ...

Delhi HC Grants Relief To Foreigner Whose Rolex Watch Was Seized By Customs, Says Waiver Of Show Cause & Hearing In 'Standard Form' Not Lawful

The Delhi High Court has reiterated that authorities making a traveller waive show cause notice before confiscation of goods, etc. under Section 124 of the Customs Act 1962, on a mere proforma, is not lawful.A division bench of Justices Prathiba M. Singh and Dharmesh Sharma thus granted relief to a permanent resident of Hong Kong, whose Rolex wristwatch valued at ₹30,29,400/- was confiscated by the Customs Department at the airport.It observed, “This is another case where the Department is...

Customs Department Must Intimate Party About Disposal Of Confiscated Property Both Via Email And On Mobile: Delhi High Court

The Delhi High Court has held that the Customs Department must ensure that the intimation of disposal of detained or confiscated property is given to the concerned party both via email as also the mobile number.A division bench of Justices Prathiba M. Singh and Dharmesh Sharma reasoned this will ensure that a party who succeeded in Court or Tribunal against the detention of the property is not deprived of their properties.The observation was made while dealing with a case where despite the order...

Delhi High Court Orders Customs To Release Traveller's Gold Worth ₹20 Lakh, Iphone, Playstation & More Over Failure To Issue SCN

The Delhi High Court recently ordered the Customs authorities to release a traveller's gold worth over ₹14 lakh and other branded articles like iPhone, PlayStation, etc. over the authority's failure to issue him a show cause notice.Section 124 of the Customs Act, 1962 contemplates issuance of a show cause notice before confiscation of goods.The Petitioner had landed at Delhi International airport with his family. He was intercepted carrying a gold chain, another three layered gold chain with...

No Unfettered Right To Cross-Examine Person Making Statements U/S 138(B) Customs Act: Delhi High Court

The Delhi High Court has made it clear that a person facing charges under the Customs Act, 1962 does not have an unfettered right under Section 138B, to cross-examine the informant or person making incriminatory statements.Section 138(B) of the Customs Act of 1962 deals with the admissibility of statements made during customs proceedings.A division bench of Justices Prathiba M. Singh and Dharmesh Sharma relied on Kanungo & Co. v. Collector of Customs, Calcutta and Others (1983) where a...